In a response to the current double whammy of low crude oil prices and COVID 19 outbreak which resulted in global economic slowdown, The European Central Bank launched 750 billion euro emergency bond purchase scheme in a bid to stop a pandemic-induced financial rout from shredding the euro zone’s economy and raising fresh concerns about the currency bloc’s viability.

As Europe is in lockdown amid the coronavirus outbreak, economic activity has come to a near standstill and markets have been in a tailspin, foreshadowing a deep recession on par with or perhaps even worse than the 2008 global financial crisis and raising questions about the euro zone’s cohesion at times of stress. Under pressure to act to bring down borrowing costs for indebted, virus-stricken countries such as Italy, the ECB launched a new, dedicated bond-purchase scheme, bringing its planned purchases for this year to 1.1 trillion euro with the newly agreed buys alone worth 6% of the euro area’s GDP.

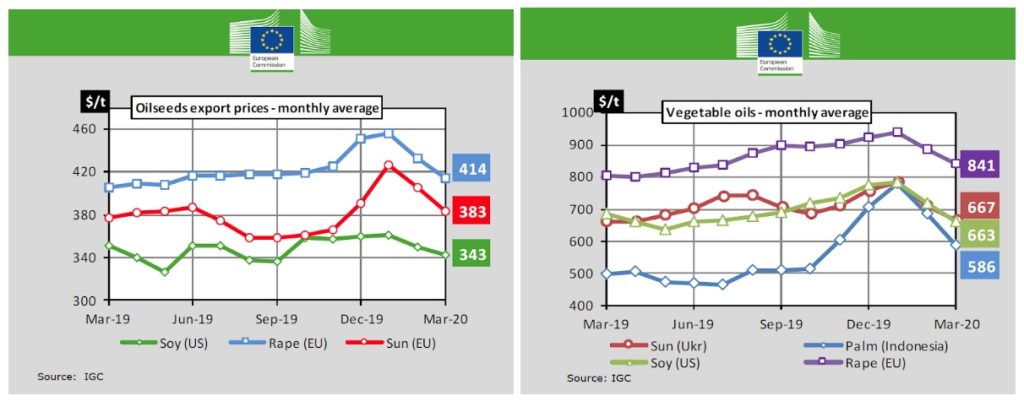

The impact of the low crude oil prices over the past week coupled with the slow demand of commodities due to movement restrictions or lockdowns in many European countries has seen the demand for edible oils and oilseeds shrinking. This is reflected in the prices of major oilseeds which has seen a tailspin over the last few days as slowing demand wreaked havoc on commodities market. In an effort to remedy that, the Temporary Framework provides for five types of aid:

- Direct grants, selective tax advantages and advance payments: Member States will be able to set up schemes to grant up to €800,000 to a company to address its urgent liquidity needs.

- State guarantees for loans taken by companies from banks: Member States will be able to provide State guarantees to ensure banks keep providing loans to the customers who need them.

- Subsidised public loans to companies: Member States will be able to grant loans with favourable interest rates to companies. These loans can help businesses cover immediate working capital and investment needs.

- Safeguards for banks that channel State aid to the real economy: Some Member States plan to build on banks’ existing lending capacities, and use them as a channel for support to businesses – in particular to small and medium-sized companies. The Framework makes clear that such aid is considered as direct aid to the banks’ customers, not to the banks themselves, and gives guidance on how to ensure minimal distortion of competition between banks.

- Short-term export credit insurance: The Framework introduces additional flexibility on how to demonstrate that certain countries are not-marketable risks, thereby enabling short-term export credit insurance to be provided by the State where needed.

Prices of oilseeds and oils and fats has dropped significantly due to the current economic uncertainties as seen below:-

Based on a statement made recently by a European Commission high official, a short-term recovery in price and demand for goods and supplies seem unlikely as economic activity comes to almost a standstill. Economic growth in the eurozone and throughout the entire EU will “most likely” fall below zero this year as a result of the coronavirus crisis. The next forecast, expected in May, will be reviewed considerably downwards. According to estimates, the direct impact of the crisis, will reduce GDP growth in 2020 by 2.5 percentage points compared to a situation without a pandemic. “Given that the real GDP growth should be 1.4% for the EU in 2020, it could fall below 1% of GDP in 2020, with a substantial but not complete rebound in 2021,” an EU document noted.

Prepared by: Izham Hassan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.